WHY BUYING PROPERTY MAKES SENSE IN 2021

by Agnes Gaddis August 18, 2021

Are you on the fence about buying in 2021? This post will offer some clarity. If you’re looking for a comparison of renting vs buying that goes into detail about how buying vs renting a home will affect your finances in 2021, you should read to the end. We’ll look at what you should consider before buying a home or renting, and some stats on rent versus buy across US major cities.

Overview of Renting in 2021

The real estate rental market is an oddball. It is difficult to predict that in 2020 many millennial renters would take advantage of low mortgage rates to become homeowners, causing a strong imbalance between supply and demand. On the other hand, prices and intense competition for homes have driven some high income, would-be home owners into becoming renters out of necessity.

But high income renters snapping up single family rentals and multifamily apartments isn’t a new trend.

Based on a report by Rentcafe, between 2007 and 2017, more than 1.35 million people, earning $150,000 per year switched to renting – that is a 175% increase. During this ten year period, the number of renter-occupied households earning over $150K per year multiplied 7.4 times. Also, the number of high income tenants in Charlotte, NC grew by 400%.

In 2020, rental demand also took an unexpected curve as many people moved away from big cities like San Francisco and Seattle for more affordable housing. Before the Covid-19 pandemic, rents at these tech hubs were exorbitant with relentless demand. But with the adoption of remote work and telecommuting, the demand shifted to the suburbs closest to these big cities.

As companies open up fully and rental demand picks up in these cities, rent prices pick back up. Nationwide, rents have risen in almost all of the biggest metros. Zumper reports that in July, the National Rent Index rose 7 percent year-over-year for one-bedroom apartments and a staggering 8.7 percent for two-bedroom apartments.Rents are likely to continue to rise as new home construction has fallen well short of the 4.6 million units needed per year. Demand for rental properties, especially from high-income earners, is driving rent beyond the reach of low-income earners.

Let’s consider the case for renting:

1. While rent prices have increased, home prices have appreciated since 2020 at almost unbelievable rates. In some markets, home buyers are rushing foolhardy into deals because of bidding wars. Asides from that, buying a home requires that you have enough money to cover not only your down payment but closing costs, PMI, realtor fees, legal, inspection, and appraisal fees. You also need to spend money on property maintenance including HOA dues.

2. With renting, you aren’t tied to a particular place for years. This is one of renting’s appeals to young millennial professionals. The ability to work from anywhere has led to a number of millennials migrating to places like Honolulu for short term rental stays. Of course, you can also take long vacations if you own your own home, but it just doesn’t offer enough flexibility as renting.

Buying a Home – 2021 Overview

It is no news that home prices have appreciated above expert forecasts in 2020 and 2021. According to Zillow data, the typical seasonally adjusted value of a median single-family home in the United States in June 2021 is $293,349. This is up 15% from a year ago, and Zillow expects prices to appreciate even more, by 13.2%, in June 2022. Read more about what to expect in the 2022 real estate market.

Buying a home is part of the American dream. However, if you’re thinking about buying a home in 2021, you may want to be a bit more cautious, as mortgage rates are rising, homes are selling above fair market value and banks are demanding higher down payments.

So should you rent or buy in 2021? Let’s consider the pros of buying a home in 2021.

1. Mortgage rates are still low. Even though mortgage rates have been predicted to pass the 3.25 mark by the end of 2021, they are still currently low. In May 2021, according to Freddie Mac, interest rates on 30-year loans averaged 2.96%. But they won’t stay that way.

One of the disadvantages of waiting to buy a home is that price appreciation could slow, but mortgage rates could rise. However, in 2021, mortgage rates have gone up and down: there has not been a steady upward trend. Overall, a sharp rise in rates is unlikely.

2. Home equity is strong. As home values rise, so do home values in many markets. Even for people who have defaulted and face the threat of foreclosure, home values may offer leverage. The possibility of gaining from home appreciation is one of the best arguments for buying a home in 2021.

3. Freedom. If you own your home, you are free to design and upgrade it any way you want. Whether you’re looking for more space, better insulation, or want to give the kitchen an upgrade – you can make your home fit your lifestyle – of course as long as you don’t break HOA rules. This sense of ownership and freedom to customize your home make owning a house more desirable than renting.

While these sound great, you should consider the current renting vs buying landscape. The fact is, if you were bidding on a house in any market in the US Right now, you probably aren’t the only one bidding on the house. Currently, there are more buyers than listings and this means there will be bidding wars. In many cases, you will compete with cash offers. ATTOM Data Solutions reports that cash offers account for over a quarter of all home purchases these days.

Is it Better to Rent or Buy in 2021? Considerations

One of the major factors driving the renting vs buying debate is affordability: Is buying really cheaper than renting?

There are no quick and fast answers. Attom Data’s 2021 rental affordability report showed that owning a median-priced three bedroom home is more affordable than renting a median-priced 3 bedroom home in 63 percent of 915 US counties. However, this research was conducted in 2020. Also. it does not take into account the fact that people who pay less than 20% down will pay more in mortgage payments each month.

Based on an article on TheMortgageReports, “In 2019, the National Association of Realtors found that the average down payment on a house or condo was just 12%. For first-time home buyers, that number drops to 6%. And many people put down even less money — or no money at all.”

If, according to the NAR, the median price of a home is $350,300, with a 6% down payment requirement, you’ll be paying $21,018 down. Conversely, a 20% down payment would offer you a better rate and an opportunity to forego PMI (private mortgage insurance). But you’ll need to have saved up to $70,060.

If you’ve been saving up to buy a home in 2021, how about first comparing the cost of owning versus the cost of renting? Nerdwallet has a renting vs buying calculator to help you compare which of renting vs buying will be the best fit for your situation.

In most cases, you need to consider some things as you examine renting vs buying pros and cons. You want to ask the following questions:

1. How long am I staying in the area?

2. What are the current mortgage rates? and what are the terms of the mortgage?

3. Are home values appreciating in the area? Will they continue to appreciate in the future?

4. Am I willing to spend money and effort on routine home maintenance?

5. How much of my taxes can I deduct as a homeowner?

Although you shouldn’t hinge your rent versus buy decision on cost – you want to consider convenience and lifestyle too. But the cost is an important consideration.

Ongoing costs for renters include; rent, renter’s insurance, utilities (electricity, gas, water, cable,…) – some landlords could include utility costs in the rent.

At the start of your tenancy, you have to pay a one time security deposit. The security deposit varies by state. In most states, it is usually one or one and a half month’s rent. Some landlords also charge additional fees for garbage pickup, pest control, and parking.

When buying a home, you’ll pay a one time closing cost, which will include your mortgage origination fee, plus a one-time down payment. Ongoing costs include your mortgage fee plus PMI (private mortgage insurance), property tax, HOA fee, utilities, and home insurance. You might also need to spend money on routine home maintenance and renovation tasks. Let’s look more closely at the questions above.

- Home Equity

Are home values appreciating in the area? Will they continue to appreciate in the future?

Right now, there is a fear of missing out as low supply drives fierce competition for available homes. Economists have compared this to the 2006-2007 buying frenzy. But compared to 2007, when many people who rushed to buy a home due to attractive mortgage terms lost their homes to foreclosures and bankruptcies, home equity is currently strong.

A lending institution owns a portion-or the entire-of home if part or all of it was purchased via a mortgage loan. Equity refers to the portion of a home’s current value that an owner possesses at any given time. Note that larger down payments on a home confer a homeowner with more home equity than a smaller downpayment.

With consistent mortgage payments, every month and a strong market, the values of many homes have increased in 2021. With that, equity has risen much faster compared to the 2007 period.

As of the first quarter of 2021, CoreLogic’s Homeowner Equity Report indicates that the average homeowner has increased their home equity by $33,400.

Approximately 62% of all homeowners have mortgage loans, according to the report, and their equity increased by 19.2% between 2020 and 2021. Across the United States, the collective gain reached $1.9 trillion.

How is home equity calculated?

Most equity calculations are based on the current market value appraisal of the property and are largely dependent on demand and supply factors. let’s say you buy a house for $200,000 ten years ago with a 20% downpayment on your mortgage. For a 30 year mortgage, and at a 3.8% interest rate, you’ll be paying a $943 mortgage. If in 10 years $50,300 of payments are applied to the principal

Over those ten years, if property prices appreciate in your area by $200,000, you’ll have equity of:

Downpayment (40000) + mortgage payments (applied to principal) + home appreciation = $40000 + $50,300 + $200000

That is $290,300.

On the other hand, if you invest in the wrong location over a long stretch of time, homes may depreciate in value. This was what happened in 2007 when many people lost their homes as home values in many places depreciated. And people who defaulted on their mortgage payments had nothing to fall back on.

As a homeowner, you can use home equity in the form of an additional line of credit or home equity loan (second mortgage) to purchase other properties for investment or to finance large home renovations.

Renting gives you no equity. You contribute to your landlord’s equity by paying rent. However, there are arrangements like rent-to-own that provide the option to buy a property after your lease is over. But these deals can be risky, so you should proceed with caution.

- Mortgage

What are the current mortgage rates? and what are the mortgage terms?

If you’re not buying a home with cash, you should definitely consider how current mortgage rates affect you and whether taking out a mortgage might be better than renting.

In 2020, a significant number of millennials bought new homes because interest rates were low. Interest rates are still low but definitely not as they were in 2020. And rates keep rising as the economy improves.

Currently, in 2021, homes are in short supply. This means you should expect to pay more for a home than fair market value in the face of competing offers and homes selling in 3 weeks.

Nerdwallet predicts that the 2021 fourth quarter rate for a 30 year fixed rate mortgage will average 3.3%. If you bought a home in January, the average mortgage rate for the same type of mortgage was 2.842%. Let’s compare how your payments will change in both cases if you were buying at the current median price of $329,000:

If you bought a home in January and could afford to pay a 20% downpayment, you’ll currently pay $1,370 monthly. But if you’ll be buying when mortgage rates hit 3.3%, under the same conditions you’ll pay $1,435 monthly. That’s a $65 difference – not much! But consider that you’ll pay this difference for the entire term of the loan (30 years).

Your mortgage payments will also vary by the type of mortgage you opt for. Across the board, 30 year fixed mortgages are the most popular and also the most recommended. With 15 year fixed mortgages and adjustable-rate mortgages, expect to pay more monthly.

ARMs allow you to pay a fixed rate for a specific introductory period, which can last for 7 to 10 years. During the introductory period, you typically get a lower interest rate than you would with a fixed-rate loan. Upon expiration of the introductory period, your interest rate will follow market rates. You can expect the interest rate on an ARM to rise or fall up to a certain limit over the course of the loan. There are also jumbo loans that do not conform to lending limits set by Fannie Mae. But these are usually tough to get.

Generally, whether for fixed rate or adjustable rate mortgage, Your loan’s principal is large at the beginning, and the majority of your payments go to interest. In return, you pay less in interest as you reduce your principal over time. An amortization schedule will reflect consistent monthly payments and will help you pay off your loan on time.

Another thing to know in 2021 is that lenders are going to take a closer look at your ability to pay. To get pre-approved for a mortgage, your income, debts, employment, and financial accounts will be scrutinized. With lingering Covid-19 uncertainty and the economy still recovering, lenders have imposed stricter mortgage standards. Therefore mortgage applications will usually require larger down payments and higher credit scores.

Renters do not have to worry about these. And it’s not uncommon for renters with bad credit scores who wish to buy homes, to rent for a while as they work on rebuilding their credit.

- Home maintenance.

Am I willing to spend money and effort on routine home maintenance?

One of the advantages of owning a home is that you get to design and improve your home as you see fit (keeping with HOA rules). But, financially comparing renting vs buying, you might pay more than 2 months of rent on home maintenance and emergency expenses. According to Homeadvisor, every year, the average homeowner spends $3,192 on maintenance and another $1,640 on emergency expenses.

The rule of thumb is to budget between one percent and three percent of your home’s purchase price for typical maintenance each year. You should set aside three percent per year if you are thinking about renovating your home or if you have an older home. For a home priced at $300,000, you may need to set aside up to $9,000 if you were going to renovate.

If you are buying a fixer upper or have to waive the maintenance, you’ll need to budget a lot more to get the home in tip-top condition. Generally, the following are the most common types of home maintenance issues: air conditioning and HVAC (heating, ventilation, and air conditioning) issues, doors (not opening or closing), a clogged toilet, clogged or leaking sink pipes, bathtub issues.

Randomly, you may have to deal with unexpected emergencies like broken windows, paint peeling, etc. Your budget on home maintenance and renovation will therefore likely vary each year. The costs of home maintenance add up if you plan to stay in your home for ten or more years.

During winter especially, you need to be more proactive with home maintenance and routine checks. Your doors and windows should be draught-proof to prevent warm air from escaping and cold air rushing in, your heating system might also need to work overtime. It’s essential that you keep an eye on energy consumption during this time by installing an energy monitor. You’ll need to clear gutters and driveways and improve your home’s curb appeal.

Asides from these maintenance costs, there are also homeowner association dues which range from between $200 to $400 per month. For upscale buildings, expect to pay more in HOA fees. HOA dues could cover lawn care, sewage, trash removal, etc.

As a renter, unless otherwise stated in the rental agreement, your landlord is responsible for handling property maintenance tasks and HOA fees. And if you’re a landlord, see this checklist for rental property maintenance.

- Tax deductions

How much of my taxes can I deduct as a homeowner?

As long as you keep paying the mortgage on your home, you can take advantage of the mortgage interest deduction. Up until recently, home owners were able to deduct up to $1 million in mortgage interest. Due to the Tax Cuts and Jobs Act, however, this limit is reduced from $1 million to $750,000 for a single or married couple filing jointly. Married couples filing separately can deduct $375,000 each.

On a second mortgage, home equity loan, or home equity line of credit, you can also deduct interest payments. It is important to remember that you can only claim this deduction if you borrowed the funds to pay for a home improvement.

Other deductions for homeowners and property investors include:

- Property taxes: Married couples filing jointly can deduct up to $10,000 in property taxes; singles and married couples filing separately can deduct $5,000 in property taxes.

- Discount points: Sometimes lenders offer homeowners the option to reduce their interest rate by purchasing prepaid interest or discount points. Points purchased to reduce a mortgage’s interest rate are tax deductible.

- Home office: Depending on the size and functionality of your home office space, you can deduct some of the expenses that come with having a home office. However, the space should be used exclusively and regularly for business purposes.

- Home improvements: If you make necessary medical upgrades to your home e.g. to improve accessibility by installing hand railings, you can deduct the cost of these upgrades.

While not comparable to the tax benefits of buying a home, some states offer renters tax credit. For cost burdened renters, depending on your state, you may be able to claim a credit if your rent is above 30% of income. As an example, in New Jersey, you can either qualify for an 18% deduction from rent paid, up to $15,000, or a refundable credit of $50 on your tax return.

- Length of stay

How long am I staying in the area for?

A 2013 statistic from the National Association of Home Builders (NAHB) showed that the average buyer stays 13 years in a home.This length of stay has remained the same through 2018, based on data from the 2018 1-year American community survey. A first-time buyer’s average stay in a single-family house is somewhat shorter (about 11 and a half years, compared to 15 years for buyers who have owned a house before).

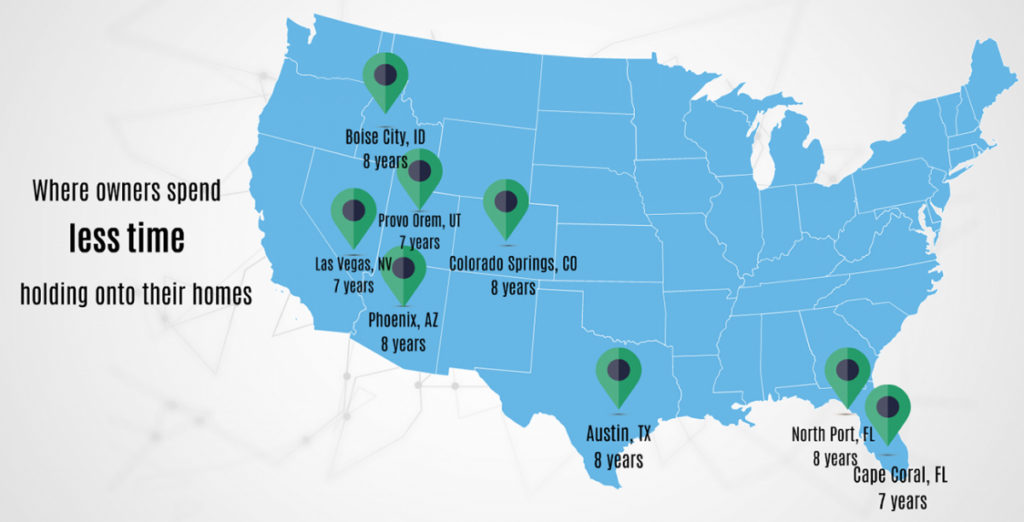

But people spend more time in some neighborhoods than others. Based on a recent research by the NAR, homeowners spent up to 8 years in the following areas.

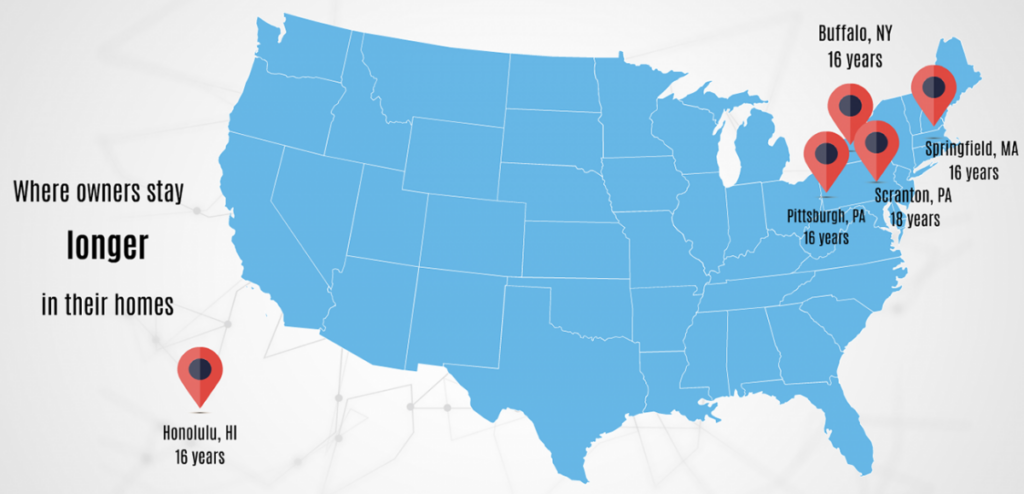

These metro areas, in contrast, have homeownership duration of 16 years or more:

According to the data, the median length of homeownership in many of the fastest-growing metro areas was the lowest. On the other hand, places that have experienced slow population growth have longer homeownership durations.

What about renting? Recent research by Renterrated, a renter satisfaction survey program, puts the average length of stay for renters at 27.5 months (less than 3 years). There are also variations in stay length based on location. The average rental stay in the northeast is 32.9 months. The South has the shortest average rental stay at 24.3 months.

Nowadays, with the preponderance of short term AirBnB rentals and vacation rentals, renters are free to up and leave for months. So an important question to ask when you’re considering renting vs buying is, would I have to move a lot due to work or other reasons?

Is Buying Really Cheaper Than Renting? Rent vs Buy Stats

Now let’s look at the stats comparing buying vs renting a home costs in the nation’s biggest metros. Note that while home prices have risen in almost all the big metros, some slowly, renting have moved in both directions – rent has declined in some cities but appreciated at a fast pace in others.

But which is cheaper? to buy or rent?

A March 2021 report by Realtor.com’s research team sheds light on this. They compared renting vs owning in 50 of the nation’s largest metro areas to see where buying beats renting, and vice versa.

They found that only 15 of the 50 metros favored buying. In those metros, on average, the cost of buying a house is the same as or less than renting.

Renting beats buying in the majority of metro areas that they examined. In light of rising home prices in the U.S. in recent years, which have eroded purchasing power, such a trend is not surprising. The top 5 places where the math favors buying over renting include:

1. Cleveland-Elyria, OH

2. Pittsburgh, PA

3. Chicago-Naperville-Elgin, IL-IN-WI

4. Riverside-San Bernardino-Ontario, CA and

5. Miami-Fort Lauderdale-West Palm Beach, FL

In these metro areas, the median listing price as of Jan 2021 was 7.7% lower than the national average of $346,000 and the median rent was 0.7% higher than the top 50 average.In January 2021, the median monthly cost to buy a home in the 50 largest metro areas was $1,988, compared to the median monthly rent of $1,727.

Note that for most research covering renting vs buying costs, mortgage rates are usually based on 30 year fixed rate mortgages and 20% down payments. You will pay more in monthly mortgage if you put down less than a 20% down payment or opt for a 15 year fixed rate mortgage.

Also, mortgage rates in January were a bit lower than they are now. Conversely, in many cities, rent prices have appreciated rapidly from March 2021 to July 2021.

But based on the report by Realtor.com, the top 5 places where renting favors buying include:

1. San Jose-Sunnyvale-Santa Clara, CA

2. Austin-Round Rock, TX

3. Sacramento-Roseville-Arden Arcade, CA

4. Seattle-Tacoma-Bellevue, WA

5. San Francisco-Oakland-Hayward, CACompared to the January 2021 national listing price of $346,000, the median listing prices in these metros were 105% higher. On average, renters in these metros saved 30% compared to home buyers. “It’s not surprising that buying makes more sense where real estate is affordable and the median sales price is lower than the national median price,” said Chief Economist of realtor.com Danielle Hale. We can conclude that affordability is the major reason why people opt for renting over buying.

A more recent survey by LendingTree showed that across the nation’s largest metros, renting is $606 cheaper than owning (if you’ve not paid off your mortgage). New York, San Francisco, and San Jose, Calif., are the metros with the greatest difference between renting and purchasing a home. For these three metros, renting is about $1,200 cheaper on average versus owning a home while paying off a mortgage. Florida’s Orlando and Tampa as well as Indianapolis have the narrowest gap between home buying and renting. Renters in these metros can save an average of $335 a month.

Should You Buy or Rent in 2021?

There is no right or wrong answer. If you believe that buying is better, then just buy a property. However, if you’re not sure and don’t want to make any decisions now, it’s better to rent.

Financially, there are both pros and cons to renting and buying, but you also need to consider your lifestyle needs. Do you want to be able to change things up easily, like painting and decorating? And do you prefer the sense of ownership that comes from knowing you have a place of your own? Then you should buy a house.

Do you travel a lot? And you don’t want to handle the stresses that come from home maintenance tasks such as repairing water damage? Then you should rent.

Here’s a summary of renting vs buying pros and cons:

- When you rent, there is no need to worry about maintenance costs or upkeep. You always have a landlord who will take care of any repairs that may arise from time-to-time. Furthermore, with monthly payments and the freedom to move at all times without penalties, renting provides flexibility in your lifestyle choices should something change unexpectedly!

- The tangible advantages of homeownership come from tax deductions for things like home-improvements which are used to lower taxable income (saving money on state/federal level), there’s more than just that! Owning your property means taking pride in fulfilling part of the American dream – a home that gives a sense of security and stability.

Now you know the costs of renting vs buying property in 2021. If you want to buy a home in 2021, you want to be financially prepared. Know that:

1. Your chances of repaying your mortgage are better if you have a stable job history, a steady income, and are able to save each month.

2. If you can’t afford a down payment, renting is a better option than buying. While renting, you can start saving up for a down payment.

3. You should be ready to compete for homes at higher price points. Competition among home sellers in a market with historically low supply has led to higher prices and faster sales.

And if you’re buying a home for vacation rental or as an investment property, you should be able to assess the profitability of your investment easily. You can do that with Mashvisor’s rental property calculator.